Foodservice Insurance Group (FIG) provides an unorthodox approach to insurance coverage: as a captive, we’re 100% owned by our members, meaning our entire captive is managed specifically to benefit our members: enhanced coverage, no premium hikes and comprehensive risk management solutions that benefit the bottom line.

FIG’s Insurance Coverage Overview

Our member-owned captive is anything but traditional: in addition to the General Liability, Automobile and Workers’ Compensation insurance offerings you’d expect from other companies, we also offer Property Insurance, which provides our members a huge risk reduction and benefit to their properties.

FIG’s program is unique in that it provides a provision allowing Upgraded Valuation that occurs when each member is required to upgrade their property’s façade following a loss. FIG captive works with our nationwide members to enhance brand perception while providing comprehensive insurance solutions to cover all potential risks.

We protect over 3,500 restaurants with a combined revenue of more than $5.4 billion and property values over $4.6 billion.

Additional FIG Insurance Benefits

When you choose the FIG captive, you have access to the following additional insurance coverage benefits:

- Upgraded Property Valuation

- Builders Risk

- Terrorism and Threat

- Group Buying Power for coverage outside of captive lines

- Including: Crime, Umbrella, Employment Practices Liability, Directors & Officers, Aviation, Delivery, Workplace violence

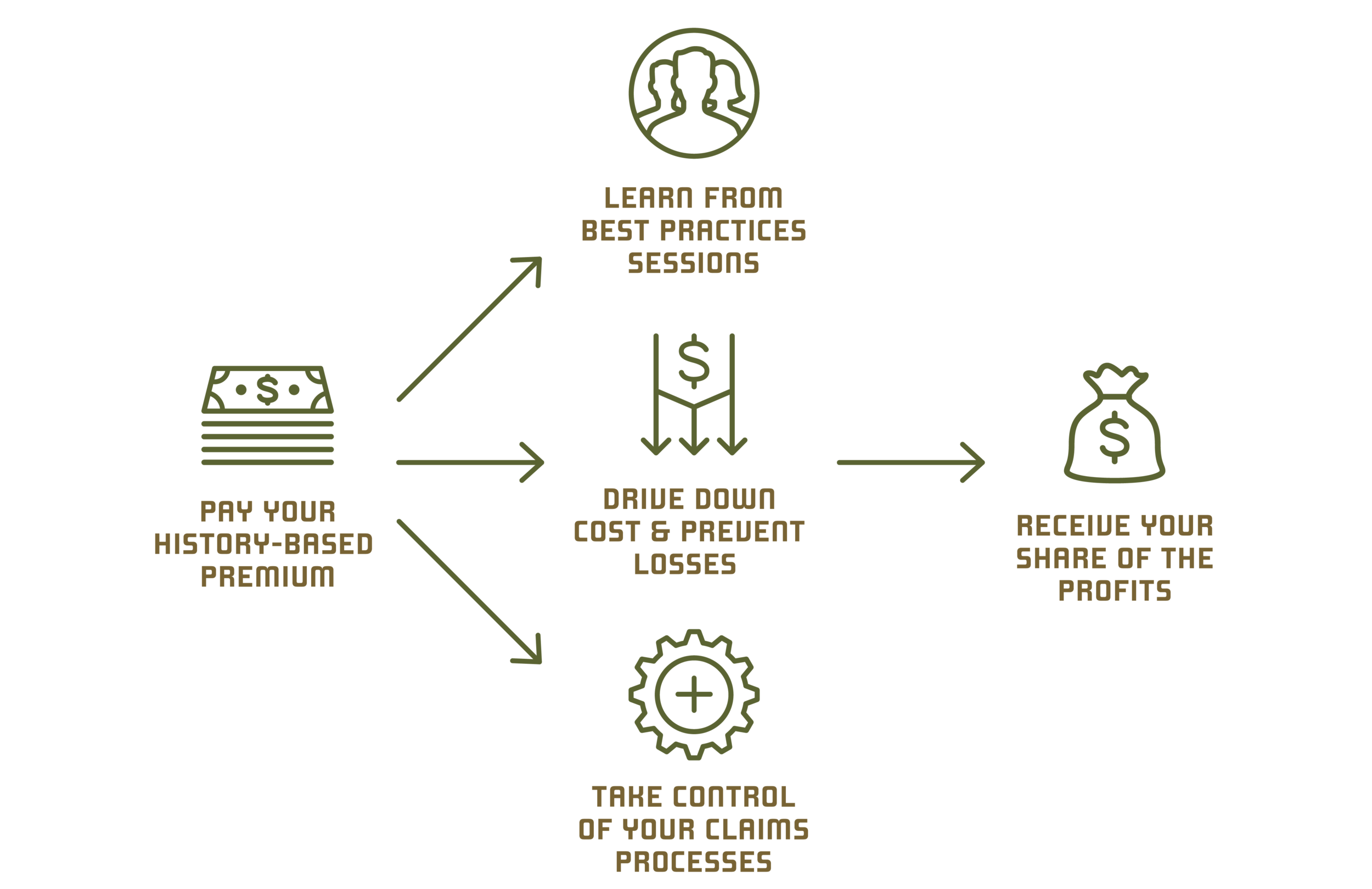

In addition to enhanced coverage and loss-based premiums (that don’t change due to external market conditions), you’ll also learn from restaurant best practice sessions; drive down cost and prevent losses; and take control of your claims processes.

FIG puts our nationwide restaurant operators in control of their insurance coverage. We take pride in our members receiving their share of their profits.

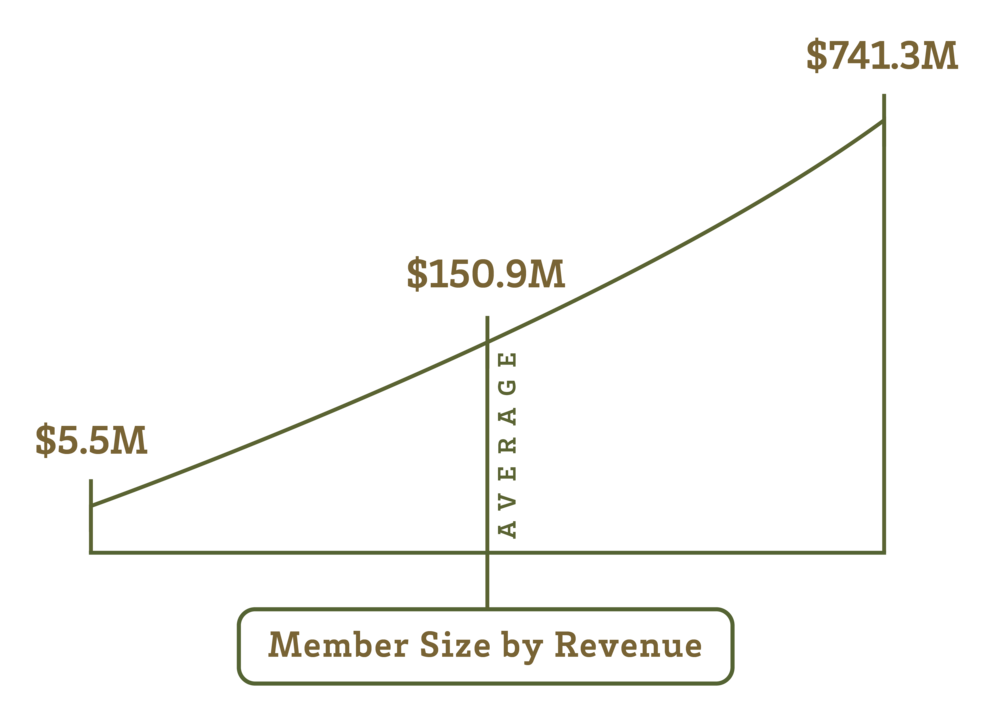

Who Needs Us?

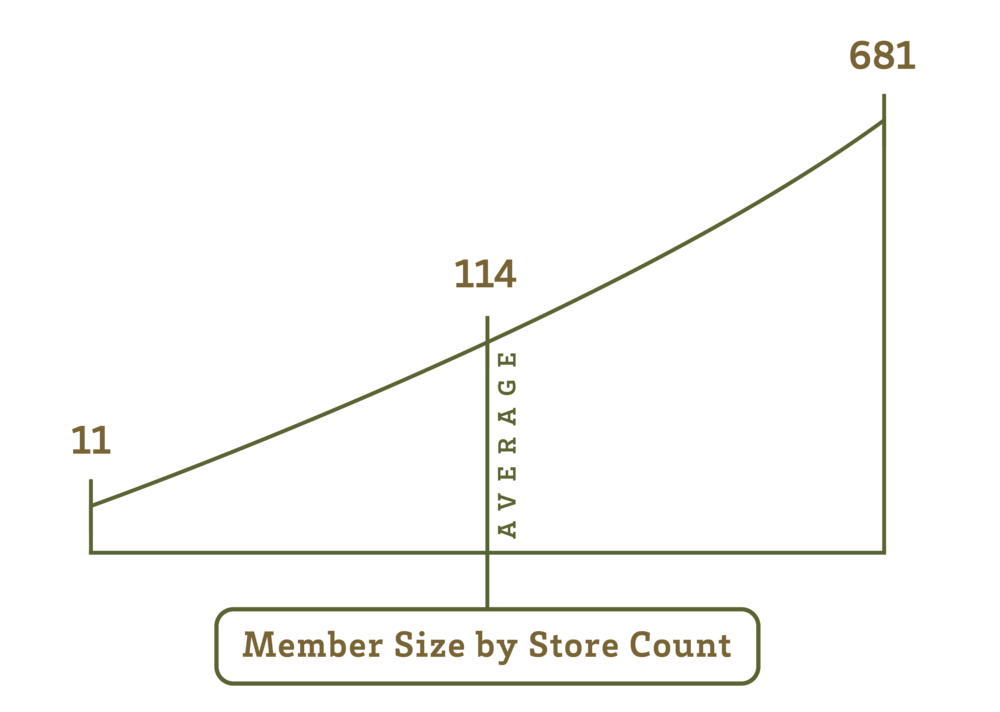

If you want to get away from the stale, one-size-fits-all insurance plans and enjoy a relationship with a team that knows your restaurant business inside and out, you should consider joining FIG. If you’re the owner of 25+ restaurants or you have 250k+ in premium, you’re leaving money on the table and are a prime candidate for membership.

There are many reasons to leave cookie cutter risk management strategies behind and work with a group that knows their way around a kitchen:

- Enjoy full transparency with your risk program

- Learn from other restaurant owners

- Prevent loss significantly using our best practices

- Take complete control of your insurance pricing

- Work with experienced restaurant risk pros

- Share in the profits from your insurance coverage

Our Members

We are proudly owned by our members—restaurant operators who decided to slice and dice the old risk management model. The FIG captive is managed specifically for their benefit, and the benefit extends beyond a share of the premium credits. It comes in the form of industry-leading best practices formed and implemented on a continual basis, resulting in an astounding ability to prevent loss. And, if a loss does occur, we rapidly manage that claim to ensure the most favorable outcome. We protect over 3,000 restaurants with a combined revenue of more than $4.2 billion and property value over $3.5 billion. Some of the brands that make up our membership are:

The Captive Process

The key differentiator between your typical insurance company process and ours is this: The FIG Captive process is the brainchild of its members and it’s dual purpose is to protect them from losses and return premium credits to them at the same time. It’s not canned, it’s custom. It’s an original recipe that’s been tweaked and marinated to perfection. For more specific details on the parts of the process, click on “The Pudding”.